UAC of Nigeria Plc (UACN) has reported a pre-tax profit of N10.4 billion for the nine months ended September 30, 2025, marking a 50.1% decline compared to N20.8 billion recorded in the same period of 2024. The company’s latest financial report highlights a turbulent third quarter, marked by acquisition-related expenses and underperformance in key business segments.

When adjusted for non-recurring acquisition costs and foreign exchange impacts, underlying profit before tax stood at N12.2 billion, compared to N10.6 billion in 2024—indicating that the company’s core operations remained profitable despite the temporary financial drag.

However, for Q3 2025, UACN reported a loss before tax of N703 million, a stark reversal from the N5.9 billion profit posted in Q3 2024 and a decline from the N6.1 billion profit reported in Q2 2025. This represents the company’s first quarterly pre-tax loss in recent years, underscoring the financial strain caused by its latest acquisition and rising costs across operations.

Financial Performance Overview

Key highlights from UACN’s unaudited financial results include:

-

Revenue: N159.6 billion (up 19.8% YoY from N133.2 billion)

-

Gross Profit: N39.4 billion (up 28.1% YoY from N30.7 billion)

-

Operating Profit: N13.4 billion (up 9.1% YoY from N12.3 billion)

-

Profit Before Tax: N10.4 billion (down 50.1% YoY from N20.8 billion)

-

Profit for the Period: N5.4 billion (down 60.6% YoY from N13.7 billion)

-

Earnings Per Share (EPS): 179 kobo (down from 426 kobo in 2024)

-

Total Assets: N161.5 billion (up from N157.7 billion in December 2024)

-

Total External Debt: N43.3 billion (up from N41.5 billion in December 2024)

-

Cash Balance: N46.8 billion (up from N40.6 billion in December 2024)

Despite revenue growth and solid performance in some business lines, profitability was eroded by one-off charges and sectoral weakness.

Acquisition of CHI Limited and One-Off Costs

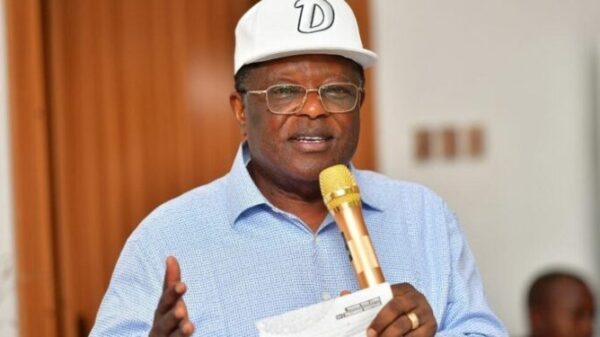

Group Managing Director Fola Aiyesimoju attributed the Q3 loss primarily to acquisition-related costs, higher finance expenses, and weakness in the Animal Feeds segment. The company recently completed the 100% acquisition of Chivita | Hollandia (CHI Limited) on October 3, 2025, following regulatory approval by the Federal Competition and Consumer Protection Commission (FCCPC).

This acquisition marks a major milestone for UACN, expanding its footprint in Nigeria’s fast-moving consumer goods (FMCG) sector and giving it full control of one of the country’s leading juice and dairy brands. However, the immediate financial impact has been negative due to acquisition-related transaction costs and integration expenses.

The company recorded a N19.1 billion “deposit for investment” in its financial statements, believed to be linked to the CHI Limited transaction. UACN clarified that full accounting for the business combination was still underway, with complete details expected in the next quarterly report.

Segmental Performance

Revenue growth was driven largely by UACN’s Paints segment, which grew 27% year-on-year to N10.2 billion, and Packaged Foods and Beverages, up 25% to N17 billion. Both segments benefited from volume growth and effective pricing strategies.

Conversely, the Animal Feeds and Edibles division was a major drag on group performance. Segment revenue fell 25% year-on-year to N21.4 billion, as global commodity price declines—particularly in maize and soya—led to high-cost inventory and reduced selling prices.

Operating expenses surged 56% in Q3 2025, driven by N2.3 billion in one-off acquisition costs, alongside increases in distribution, travel, and personnel expenses. Rising interest rates and the absence of last year’s foreign exchange gains pushed finance costs higher, ultimately contributing to the pre-tax loss.

Despite the quarterly loss, cash flow from operations remained robust at N18.5 billion, while cash reserves grew to N46.8 billion. UACN’s gearing improved slightly to 60% from 62%, and its quick ratio strengthened to 1.0x from 0.7x, reflecting improved liquidity. However, net debt to EBITDA rose to 0.6x due to higher debt and lower earnings in Q3.

Market Reaction and Outlook

The market responded negatively to the earnings announcement, with UACN’s share price falling 6.47% to close at N66.50 on the day of release. Nevertheless, the company remains among the top-performing stocks on the Nigerian Exchange (NGX) in 2025, up 207% year-to-date, though below its peak of N81 in May.

The company did not declare an interim dividend for the third quarter.

Looking ahead, analysts believe UACN’s short-term profitability pressures are transitional, tied mainly to the CHI acquisition and restructuring costs. The long-term outlook remains positive, given the company’s strengthened position in the FMCG space, diversified revenue streams, and sustained operational cash flow.

With strategic integration and cost discipline, UACN appears poised to restore profitability in subsequent quarters, as it consolidates CHI Limited and leverages its expanded portfolio to drive growth.