Ecobank Transnational Incorporated (ETI) has announced another impressive performance in its unaudited Q3 2025 financial report, recording a 47% year-on-year increase in pre-tax profit to N394.6 billion, supported by strong growth in both interest and non-interest income streams.

Profit after tax also surged 48% to N268.5 billion, even as the bank absorbed higher provisioning and a one-time loss from discontinued operations. This robust third-quarter showing lifted the Group’s nine-month pre-tax profit to N1.01 trillion, representing a 42% jump from the same period in 2024, while profit after tax climbed 43% to N702.4 billion.

Strong Core Performance Across Key Metrics

Ecobank’s growth was broad-based, powered by rising interest income, digital adoption, and foreign exchange gains across its 33-country network.

Key Highlights (Q3 2025 vs Q3 2024):

-

Net Interest Income: N588.1 billion (+34%)

-

Non-Interest Revenue: N381.5 billion (+12%)

-

Operating Profit (Pre-Impairment): N523.4 billion (+50%)

-

Pre-Tax Profit: N394.6 billion (+47%)

-

Post-Tax Profit: N268.5 billion (+48%)

-

Total Assets: N47.97 trillion (+11%)

-

Customer Deposits: N35.68 trillion (+13%)

-

Customer Loans & Advances: N16.78 trillion (+9%)

-

Shareholders’ Funds: N3.69 trillion (+33%)

The bank’s total operating income reached N969.6 billion, a 24% increase from the same quarter in 2024, reflecting a balanced contribution from both interest-earning activities and digital-driven fees.

Interest Income, FX Gains, and Digital Services Drive Growth

Ecobank’s lending activities continued to expand, with higher interest rates and loan volumes pushing total interest income to N841.7 billion, up 20% year-on-year.

The Group’s digital platforms and payment solutions also contributed meaningfully, as fee and commission income grew to N274.3 billion. The performance was further boosted by treasury and FX trading income, which rose 19% to N154.3 billion, as Ecobank effectively managed market volatility and exchange rate movements.

This mix of diversified revenue sources underlines Ecobank’s ability to balance growth between traditional banking and digital services, while maintaining a strong presence across multiple African markets.

Cost and Risk Discipline Remain Central

Despite operating in regions grappling with high inflation and currency instability, Ecobank kept expenses under control. Operating costs rose only 3% to N446.2 billion, showing disciplined cost management across subsidiaries.

However, the bank took a more cautious stance on credit risk, increasing loan impairment provisions by 64% to N129.7 billion. This approach indicates proactive risk management amid ongoing macroeconomic uncertainty in key African economies.

Strengthened Balance Sheet and Capital Position

Ecobank’s balance sheet remains solid, with total assets rising to N47.97 trillion and shareholders’ funds expanding by 33% to N3.69 trillion.

This growth reflects a combination of strong retained earnings, foreign exchange translation gains, and fair value revaluation of assets. The result is a stronger capital buffer, providing resilience against external shocks and currency swings across the bank’s pan-African footprint.

CEO’s Outlook: Resilience and Sustainable Growth

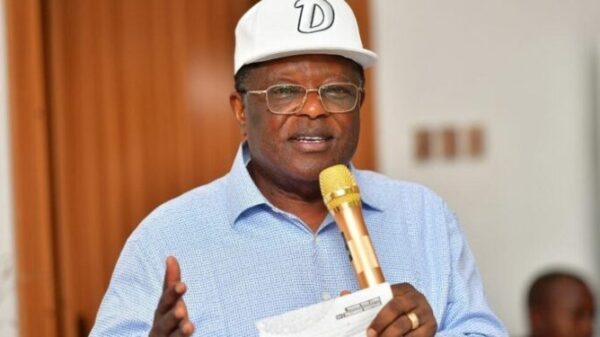

Commenting on the results, Jeremy Awori, Group CEO of Ecobank, said the third-quarter performance underscores the Group’s resilience and operational strength despite macroeconomic headwinds.

“We’re pleased with the strong momentum across our businesses this quarter. Our continued investment in digital capabilities and our ability to serve customers across 33 markets is paying off. Despite inflationary and FX pressures, we’ve delivered solid earnings, strengthened capital, and deepened customer trust,” Awori stated.

Outlook: Momentum Continues, but Risks Persist

Ecobank’s Q3 2025 results highlight solid operational execution, with robust revenue growth, improved margins, and stronger capital adequacy. The bank’s diversified income base and pan-African reach continue to position it as one of the continent’s most resilient financial institutions.

However, challenges remain. Persistent currency depreciation in some markets, inflation-driven cost pressures, and rising credit risks could impact earnings stability in the quarters ahead.

Nonetheless, Ecobank’s strong capital base, risk management discipline, and expanding digital footprint provide a firm foundation for sustained growth into 2026.