The cryptocurrency market opened the week on a strong note, with Bitcoin (BTC) climbing more than 3% in 24 hours to reach $115,171 early Monday — its highest level in weeks. Traders are eyeing the next key resistance at $120,000, as optimism builds ahead of the upcoming U.S. Consumer Price Index (CPI) report.

The bullish trend was fueled by positive global sentiment, particularly renewed progress in U.S.-China trade talks, which bolstered risk appetite and lifted prices across major digital assets.

Ethereum and Altcoins Join the Rally

Ethereum (ETH) led the altcoin recovery, soaring 6.77% to $4,196, while other major tokens — including BNB, XRP, Solana, Dogecoin, Tron, Cardano, and Hyperliquid — posted gains of up to 11% over the same period.

Overall, the global crypto market capitalization jumped 3.72% to $3.89 trillion, reflecting renewed confidence and surging trading volumes.

Among the biggest movers, Hyperliquid surged 10.51%, while Dogecoin climbed 5.77%, signaling increasing investor appetite for alternative assets and short-term momentum plays.

On a weekly basis, Bitcoin advanced 4.70%, Ethereum rose 4.25%, and other leading tokens gained as much as 26% — underscoring the strength of the current market upswing. Tron, however, slipped 6.15%, marking the only major decline among top cryptocurrencies.

Analysts See Institutional Optimism and Technical Strength

Analysts attribute the market rally to a blend of macroeconomic optimism, institutional accumulation, and strong technical signals pointing to sustained upward momentum. With CPI data due soon, traders expect short-term volatility but remain largely bullish.

The crypto market’s resilience and recovery continue to attract mainstream investors, positioning digital assets as an increasingly significant component of the global financial system.

Nigeria’s Growing Crypto Adoption

The global momentum coincides with a surge in cryptocurrency adoption across Nigeria.

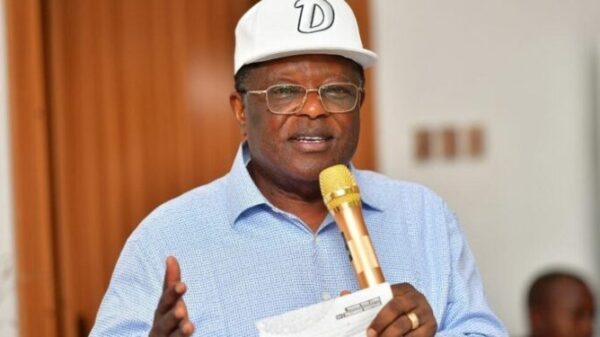

According to Dr. Emomotimi Agama, Director-General of the Securities and Exchange Commission (SEC), Nigeria processed over $50 billion in crypto transactions between July 2023 and June 2024.

At an exchange rate of ₦1,500 per dollar, this amounts to roughly ₦75 trillion — nearly two-thirds of the Nigerian Stock Exchange’s market capitalization of ₦98.8 trillion as of October 24.

Speaking at the annual Chartered Institute of Stockbrokers Conference, Dr. Agama noted:

“The sheer volume of digital asset activity underscores both the financial sophistication and risk appetite of Nigerian investors — a demographic the traditional capital market has failed to attract.”

Despite this rapid growth, Agama expressed concern over low participation in formal capital markets. Less than 4% of Nigerian adults invest in equities, while more than 60 million citizens engage in daily gambling — betting an estimated $5.5 million each day.

He warned that this imbalance reflects a shift in investment behavior and highlights the need for broader financial inclusion and investor education.

Bottom line:

With Bitcoin nearing $120,000 and Ethereum gaining momentum, the latest rally underscores growing investor confidence in digital assets — a trend mirrored in Nigeria’s expanding crypto landscape, where participation and transaction volumes continue to soar.