As Africa’s real estate industry races toward a projected $17 trillion market value, fintech innovations are emerging as a crucial force in reshaping how property transactions are conducted across the continent.

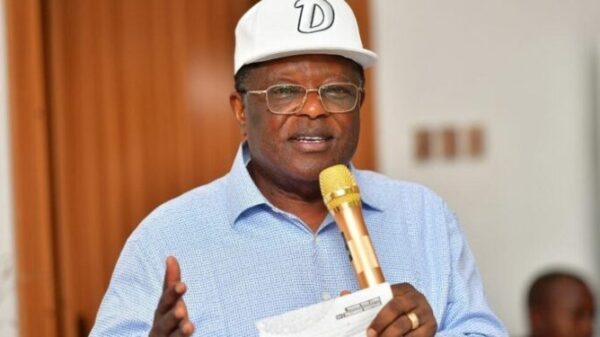

In an exclusive interview with Nairametrics, Olayinka Olamilehin, Founder and CEO of Virety, explained that financial technology and immersive digital tools are redefining trust, transparency, and accessibility in the housing and rental market.

Building trust through technology

Olamilehin noted that most real estate transactions in Africa are still dominated by manual and cash-based systems, which often result in fraud, substandard service delivery, and poor accountability.

To address this, new digital platforms now integrate fintech-powered escrow systems that hold payments until tenants confirm that property owners or hosts have fulfilled their obligations.

“We can withhold payments until the host delivers the agreed service. If guests are dissatisfied, we investigate before releasing funds. This accountability structure builds confidence and reduces fraud,” Olamilehin explained.

He added that such systems are essential for creating trust-based digital property ecosystems, preventing misuse of funds, and protecting both landlords and tenants.

Enhancing affordability and access

According to Olamilehin, rising property prices across African cities have outpaced income growth, making affordability a pressing concern. He emphasized that technology—through digital verification, virtual reality tours, and geospatial data—can cut transaction costs and help users make more informed housing decisions.

“With immersive 360° virtual tours, people can view properties remotely, save travel time, and make smarter decisions. It’s about maximizing value and precision while reducing the cost of searching,” he said.

Fintech’s growing role in Africa’s property economy

The Virety CEO believes fintech will be central to the next phase of Africa’s real estate evolution, enabling seamless cross-border transactions and instant digital payments.

He also predicted that stablecoins and digital currencies will gain ground in property payments, particularly among younger, tech-savvy property owners.

“Digital currencies may not replace cash immediately, but they’ll become a valid payment option—especially for early adopters in the property space,” he said.

Data protection and regulation

On data privacy, Olamilehin emphasized that digital housing platforms must strictly comply with privacy laws and use licensed service providers.

“At Virety, we only collect data necessary for operations, and always with user consent,” he said, stressing the importance of regulatory oversight to foster public confidence.

A $17 trillion opportunity

Citing recent projections, Olamilehin revealed that Africa’s real estate market is expected to grow from $17.64 trillion in 2025 to $22 trillion by 2029, driven by rapid urbanization and population growth.

He explained that over 75% of this value lies in residential housing, which demands greater precision, transparency, and smarter decision-making tools.

Bridging the housing gap through private sector innovation

Olamilehin also called for stronger collaboration between the government and private developers to speed up affordable housing delivery. He criticized the slow pace of public housing programs and urged private players to invest in low- and middle-income housing instead of focusing solely on luxury projects.

“The slower the delivery, the more complex the problem becomes due to population growth. The private sector must help bridge this gap sustainably,” he warned.

Infrastructure and insight

While infrastructure remains a major challenge for the physical real estate market, Olamilehin said digital platforms can provide data-driven insights to help policymakers identify investment priorities.

“The digital housing market’s advantage is access to data. This can guide governments in planning and executing infrastructure development more effectively,” he noted.

Looking ahead

With Africa’s urban population expected to double by 2050, Olamilehin believes that the continent’s real estate future will be defined by the fusion of fintech, geospatial data, and immersive technology.

“Africa’s housing crisis isn’t just about supply—it’s about trust and access. Millions still find homes through guesswork and misinformation. Digital platforms will change that by bringing transparency, accountability, and inclusivity to the market,” he concluded.