TAJBank Limited has achieved a major milestone in Nigeria’s financial sector, emerging as the country’s largest non-interest bank by total assets and gross earnings for the first half of 2025. The bank’s total assets climbed to an impressive ₦1.017 trillion, consolidating its leadership position in the fast-growing non-interest banking space.

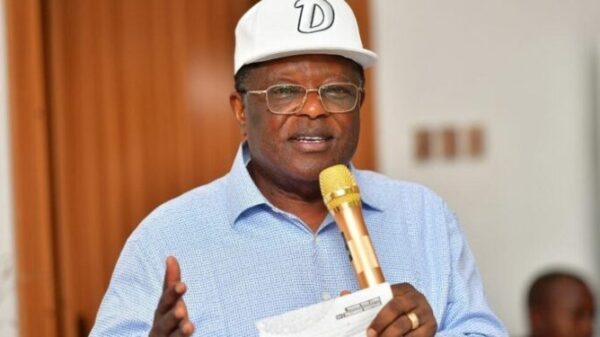

This achievement was disclosed by investment analyst and chartered stockbroker, Mr. Olabode Akeredolu-Ale, during a seminar in Abuja themed “Roles of Non-Interest Banks in SMEs’ Financing,” organized by Leaders Corporate Services.

Strong Financial Performance

According to Akeredolu-Ale, TAJBank’s total assets increased from ₦953.098 billion in December 2024 to ₦1.017 trillion by mid-2025 — about ₦53 billion higher than its nearest rival in the non-interest banking subsector. The bank also posted ₦53.752 billion in gross earnings for the first half of 2025, representing a 64% jump from ₦32.86 billion recorded at the end of 2024.

The bank’s earnings per share (EPS) also reflected strong profitability, rising to 61.36 kobo, which is 92% higher than the EPS of its closest competitor. This consistent growth underscores TAJBank’s expanding influence in Nigeria’s non-interest banking industry, which continues to attract both individual and institutional investors seeking ethical and sustainable financial options.

Industry Validation and Transparency

Speaking at the seminar, Akeredolu-Ale emphasized that all figures cited in his presentation were obtained from official financial statements and verified through regulatory platforms such as the Central Bank of Nigeria (CBN) and the Nigerian Exchange (NGX). He noted that TAJBank’s performance is a clear reflection of how well-managed non-interest banks can thrive even under challenging economic conditions.

“I am impressed by how TAJBank and other non-interest banks are leveraging innovation and ethical practices to expand access to finance,” he said. “These institutions are creating real impact by supporting Micro, Small, and Medium Enterprises (MSMEs) through non-interest funding mechanisms.”

Supporting SMEs Through Ethical Financing

The expert also highlighted that many MSMEs in Nigeria find it difficult to access credit from conventional deposit money banks due to high lending rates and tough collateral requirements. Non-interest banks like TAJBank have become critical alternatives, offering cost-friendly and ethically structured financing that aligns with Islamic banking principles.

“MSMEs should take advantage of the opportunities provided by non-interest banks,” Akeredolu-Ale advised. “They can open accounts with these banks and access affordable financing options that will help them grow sustainably.”

Recognition from Industry Experts

Another panelist at the seminar, Mr. Benjamin Chukwudi, praised non-interest banks for their growing role in Nigeria’s economic ecosystem. He credited them for not only providing access to interest-free financing but also offering valuable financial advisory services that help small businesses manage operations efficiently, especially amid rising business costs.

Chukwudi added that institutions like TAJBank are helping bridge the funding gap for entrepreneurs who might otherwise struggle in traditional banking environments.

The Road Ahead for TAJBank

Since its establishment five years ago, TAJBank has positioned itself as a leading force in ethical banking, championing financial inclusion through innovation and transparency. With total assets surpassing ₦1 trillion and consistent growth in profitability, the bank continues to set benchmarks in Nigeria’s non-interest financial sector.

Its remarkable 185% oversubscription of its recent ₦57 billion Sukuk bond also underscores strong investor confidence in its business model and long-term sustainability.

As TAJBank continues to expand its footprint, analysts believe it will play an even greater role in supporting Nigeria’s economic diversification efforts by channeling funds into productive sectors — especially MSMEs — through ethical, interest-free financial solutions.