Nigeria’s insurance industry recorded strong momentum in the second quarter of 2025, with total gross written premiums reaching ₦1.21 trillion, representing a 49.3% year-on-year increase. At the forefront of this growth is NEM Insurance Plc, which posted an impressive ₦75.41 billion in insurance revenue for the quarter, placing it among the top three general insurers in the country.

According to data released by the National Insurance Commission (NAICOM), the industry showed remarkable resilience despite macroeconomic challenges, demonstrating continued investor confidence and customer trust in the nation’s insurance ecosystem.

NEM Insurance Strengthens Market Position

NEM Insurance’s latest financial report highlights the company’s solid market performance. Its ₦75.41 billion Q2 revenue represents a significant leap from the ₦45.47 billion recorded in the same period of 2024. This growth reaffirms NEM’s position as one of the most profitable and efficient players in Nigeria’s general insurance business.

The insurer also reported total assets of ₦159.90 billion as of June 30, 2025 — up from ₦121.93 billion recorded in December 2024. Liabilities rose to ₦83.97 billion from ₦56.49 billion, while shareholders’ equity grew to ₦75.93 billion, reflecting the company’s robust capital position and compliance with the Minimum Capital Requirement (MCR) stipulated under the Nigerian Insurance Industry Reform Act (NIIRA) 2025.

Despite a strong revenue rise, profit before tax dropped to ₦3.08 billion, compared to ₦17.94 billion in the previous year, largely due to increased claims and operational costs. Profit after tax also decreased to ₦2.66 billion from ₦15.48 billion in 2024.

Healthy Balance Sheet and Cash Flow

NEM Insurance’s liquidity position remained strong, with ₦11.82 billion in cash and cash equivalents at the end of Q2 2025. The company recorded ₦8.78 billion in net operating cash inflow, while investing and financing activities resulted in outflows of ₦4.46 billion and ₦5.28 billion, respectively.

The company’s share capital stood firm at ₦5.02 billion, while retained earnings rose to ₦49.40 billion. Its statutory contingency reserve increased to ₦18.75 billion, reflecting a disciplined approach to financial management and long-term sustainability.

Industry Overview: Non-Life Segment Dominates

The broader insurance market saw significant growth in the second quarter. NAICOM reported that the sector’s total assets surged to ₦4.4 trillion, up from ₦2.3 trillion in Q2 2024. The non-life insurance segment retained its dominance, contributing 67.2% of total premiums, while the life insurance segment accounted for 32.8%.

Within the non-life segment, oil and gas insurance led the pack, contributing 31.2% of total premiums, followed by fire insurance (18.9%) and motor insurance (15.8%). Other key portfolios included general accident (8.9%), miscellaneous (8.9%), marine (8.8%), and aviation (7.4%).

Recognition for Leadership and Innovation

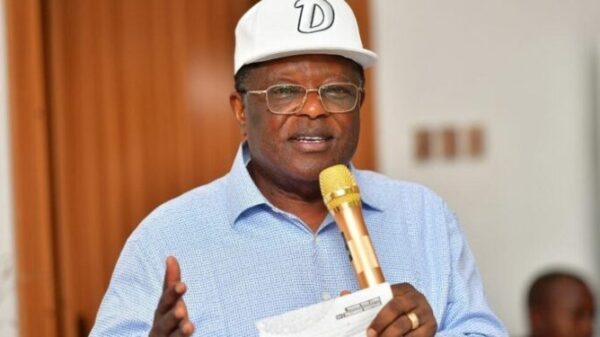

The company’s continued excellence earned NEM Insurance Managing Director, Mr. Andrew Ikekhua, a spot among Nigeria’s Top 25 CEOs, an award recognizing outstanding leadership and innovation across sectors. Organized by BusinessDay, the award celebrated NEM’s operational efficiency, resilience, and consistent customer satisfaction.

Ikekhua was commended for fostering a culture of innovation, inclusivity, and accountability that has strengthened NEM’s market presence. He attributed the company’s achievements to teamwork, discipline, and divine guidance, emphasizing NEM’s commitment to policyholder satisfaction and national economic development.

Sustained Growth and Strong Credit Rating

NEM Insurance’s performance has also earned it an “AA+ (NG)” credit rating with a Stable Outlook from Global Credit Rating (GCR), an affiliate of Moody’s. This rating reflects strong capital adequacy, prudent risk management, and consistent profitability.

As of year-end 2024, the company’s total assets had already surpassed ₦150 billion, while shareholders’ funds exceeded ₦75 billion, solidifying its position as one of the leading listed insurance firms on the Nigerian Exchange.

In 2025, NEM Insurance continued to deliver on its promise of reliability, fulfilling ₦24 billion in claims and paying over ₦5 billion in dividends to shareholders. These achievements underscore its reputation as one of Nigeria’s most dependable insurers — a brand built on integrity, financial strength, and innovation.