Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has clarified that Nigeria’s new tax framework does not introduce fresh taxes on cryptocurrency or digital income but instead provides clarity and consistency on how such earnings should be treated under existing laws.

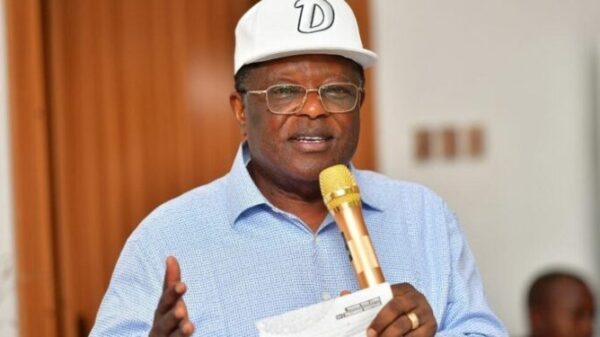

Speaking at a weekend media session with journalists, analysts, and digital influencers, Oyedele addressed the widespread misconception that the 2025 tax reforms were designed to tax crypto traders or online content creators for the first time.

According to him, income from virtual assets, social media content, and other digital activities has always been taxable under the country’s Personal Income Tax Act. The updated legislation only clarifies how such income should be declared and taxed — ensuring fairness, transparency, and compliance.

“There is no new tax on individuals who were not previously taxable,” Oyedele explained.

“What we have done is make the rules clearer — especially for digital income, influencers, and those earning from virtual assets. If you make losses, those will also be deductible. But income remains taxable, as it has always been.”

He also stressed that income received as a gift or donation remains non-taxable, as long as it is not tied to a business or service transaction.

Reducing Taxes, Not Adding More

Oyedele emphasized that one of the central goals of the fiscal reforms is to simplify Nigeria’s tax structure, which currently contains over 60 different taxes and levies.

“We are bringing that number down to fewer than ten,” he said. “This is not about raising taxes but making them simpler, fairer, and easier to comply with.”

He revealed that several unpopular levies introduced by previous administrations have already been reversed or suspended, including:

-

The 5% tax on airtime and data

-

The cybersecurity levy on bank transfers

-

The carbon tax on single-use plastics

-

The excise duty on imported vehicles

Oyedele described the new framework as “people-centric and growth-focused”, aimed at boosting compliance and promoting a friendlier business environment.

“Our reforms are designed to make life easier for citizens and businesses,” he added. “We want to promote efficiency, fairness, and trust in the tax system.”

Higher-Income Nigerians to Contribute More

While assuring that low- and middle-income Nigerians will face no new burden, Oyedele disclosed that the top 3% of income earners will now contribute up to 25% of their income in taxes.

Meanwhile, workers earning the national minimum wage of ₦70,000 or below will remain completely exempt from personal income tax under the new laws.

“Our objectives have been clear from the start — reduce the tax burden on ordinary Nigerians, harmonise multiple taxes, and build a fair, globally competitive system,” Oyedele said.

How Crypto and Digital Income Will Be Taxed

To clarify how crypto-related income fits into Nigeria’s tax system, economist Kalu Aja provided simple examples for better understanding:

-

If a person receives $100 (₦100,000) as a gift from abroad, it is not taxable, since it’s below the ₦800,000 annual threshold for personal income tax.

-

If that money is used to buy Bitcoin and later sold for ₦200,000, the ₦100,000 profit also falls below the taxable threshold.

-

However, if profits exceed ₦800,000 — for example, earning ₦1.9 million from crypto trading — income tax applies.

-

For registered companies, crypto gains may fall under corporate tax, unless the business earns less than ₦50 million annually, in which case it remains exempt.

This structure ensures that small-scale traders, freelancers, and startups are not overburdened, while higher earners contribute fairly to national development.

Building a Modern, Transparent Tax System

Oyedele reiterated that the reforms are part of a comprehensive fiscal overhaul aimed at boosting government revenue, encouraging business formalization, and simplifying administration.

The reforms — officially gazetted and signed into law on June 26, 2025 — introduce four major legislations:

-

Nigeria Tax Act (NTA) 2025

-

Nigeria Tax Administration Act (NTAA) 2025

-

Nigeria Revenue Service Establishment Act (NRSEA) 2025

-

Joint Revenue Board Establishment Act (JRBEA) 2025

Together, these laws establish a modern tax ecosystem built on fairness, simplicity, and digital compliance.

“This is not about punishment or control,” Oyedele concluded.

“It’s about giving Nigeria a tax system that works — one that supports innovation, rewards honesty, and drives growth for everyone.”